On 21 January 2020, under their obligations as the main media regulator in the UK to investigate the impacts of mergers on media plurality, Ofcom was issued a Public Interest Intervention Notice (or “PIIN”) by the UK’s Secretary of State (SoS) for Digital, Media, Culture, and Sport (DMCS).

Ofcom was asked to investigate (under section 44A of the Enterprise Act 2002 by 13 March 2020) the public interest impacts of a merger between Daily Mail and General Trust (DMGT) and JPI Media publication groups in terms of a sufficient plurality of views in newspapers in each market for newspapers in the UK. The Competition and Markets Authority (as part of the Public Interest test) was separately required to report to the Secretary of State on the grounds of competition policy.

As we’ve mentioned previously, Australia has no such equivalent public interest test that works on plurality grounds.

Interestingly, the Public Interest test ground on which Ofcom was requested to report by the SoS for DMCS related solely to the impact on the plurality of views in newspapers. But recognising the wide-spread societal changes to the way news is now distributed and consumed in the UK on multiple platforms and devices, Ofcom chose to take into account the wider UK news market.

Investigation of the plurality impacts of the DMGT and JPI Media Publications is the fourth major Public Interest test undertaken in the UK since the introduction of Ofcom’s Media Pluralism framework, but only the second involving newspapers (the first involving Trinity Media, now known as ‘Reach’). Previous investigations involving the Public Interest test on completed acquisitions have included: the said acquisition by Trinity Mirror plc of publishing assets of Northern & Shell Media Group Limited in June 2017; the acquisition by International Media Company of shares in Lebedev Holdings Limited and by Scalable Inc of shares in Independent Digital News and Media Limited in June 2018; and the proposed acquisition of Sky plc by 21st Century Fox Inc. which was ultimately surpassed by a knock out bid by Comcast then only to end up as part of the Disney and News Corp buy out arrangements in March 2019.

It’s worth briefly mentioning key points of perhaps the best known of these earlier investigations, the BSkyB/Twenty First Century Fox merger. The investigation by Ofcom in that merger had two distinct components, one relating to sufficient plurality and the other relating to broadcasting standards. On the question of sufficient plurality, Ofcom’s advice to the SoS for DCMS was that the proposed merger raised significant public interest concerns as a result of the increased influence of the Murdoch Family Trust over the UK news agenda and the political process. As a result it found this may justify making a reference by the SoS to the CMA.

Ofcom recommended, among other options, the option of a specific undertaking whereby Sky News would establish an independent editorial board to mitigate and insulate Sky News from the influence arising from the control by Twenty First Century Fox.

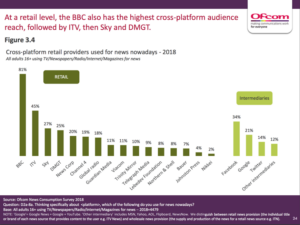

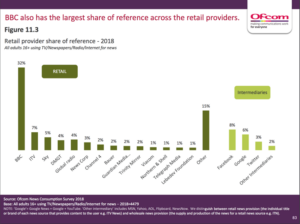

In terms of the Ofcom’s plurality measurement framework which was used to assist Ofcom in making their decision, the share of ‘cross platform audience’ and ‘Share of Reference’ metrics (from their 2018 News Consumption Survey) are shown in the following slides:

The slides show how, at a retail level, cross platform audience reach is led by the BBC, ITV, Sky and DMGT in that order. For the share of reference metric, it can be seen again to be led by a long way by the BBC, followed by the same players: ITV, Sky and DMGT media groups. Interestingly, the major ‘intermediary’, Facebook, has a greater share than the second, third and fourth media groups.

The most recent Ofcom application of a Public Interest test has been in advice provided to the UK Secretary of State for the Daily Mail and General Trust plc takeover of JPI Media Publications limited in March 2020.

While all the Public Interest test applications following the introduction of the Measurement Framework have relied on the Share of Reference mechanism, this latest decision is particularly interesting for us because of a fairly detailed discussion of brand influence and title ‘voice’, in the context of the assessment of sufficient pluralism. Ofcom have also delved into a distinction long used in pluralism policy and regulation analysis: between the ‘external’ and ‘internal’ pluralism dimensions of the takeover. The former has been applied to the wider newspaper market in the UK, while the latter has been deployed in relation to the stable of DMGT titles themselves.

The overall summative findings in their advice to the SoS are that the “transaction should be considered in the context of the challenges faced by newspapers in a changing news market” and, that Ofcom, “do not expect the transaction to reduce the plurality of views provided across newspaper groups in the UK”. While it is noted that the number of media groups in the UK has dropped from seven to six, the argument is made that the number of titles has not changed. Furthermore, and drawing on the slides shown below, the i newspaper has a relatively small readership with less than 0.1% share of cross media news consumption. It is suggested that this increase in total DMGT share makes little difference to the overall share post-merger. There’s analysis of the audience of the i newspaper indicating that the readership tend to use a larger than typical range of news sources, and this therefore provides an ameliorating effect through the dilution of the i’s impact for this group.

In their recommendation on the DMGT/JPI Media deal to the SoS, Ofcom gave the merger the green light. Their argument was that the nominal increase of share of reference in ‘retail’ sources flowing from the merged group (see the slides above, where retail reach increases by 1% and share of reference change is less then 1%), and the likely survival of the ‘i’ (newspaper) voice in the DMGT group’s titles (in itself an interesting argument involving insulated editorial control etc.), maintains ‘sufficient pluralism’ and therefore warrants it going ahead.